OUR FOCUS MARKETS

Industrial and Logistics

Definition

In 2021, the industrial and logistics market continued to experience strong demand. The market has been a major beneficiary of pandemic-related lockdowns, which resulted in a structural shift of retail sales moving online and a record amount of warehouse space take-up.

Throughout last year, the Group completed on just under 500,000 sq ft of industrial and logistics development and, in response to high demand, have committed to a further c.1,000,000 sq ft of industrial space, with a Gross Development Value of £165m.

ASSOCIATED BUSINESS SEGMENTS

- Henry Boot Developments Limited

- Henry Boot Construction Limited

KEY PROJECTS

- Markham Vale – The scheme has delivered 2,000,000 sq ft of industrial and logistic space since 2004 and in 2021, a further 297,000 sq ft was delivered over two units.

- New Horizon, Nottingham – The 45-acre scheme secured funding from Oxenwood Real Estate to commence development of seven logistics units totalling 426,000 sq ft.

- Wakefield Hub – The 200-acre site continued to make good progress last year, by pre-letting a 260,000 sq ft unit to a German pharmaceutical company.

Definition

The residential market performed well last year, with UK house prices increasing as many households re-evaluated their housing needs. The strong demand for UK housing underpinned housebuilders needs to replenish their land portfolios, with greenfield land values also increasing.

With over 92,500 plots of land within our strategic land portfolio and an aspiring multi-regional housebuilder, the Group is well placed to meet the market’s future growth requirements.

ASSOCIATED BUSINESS SEGMENTS

- Hallam Land Management Limited

- Stonebridge Homes Limited

KEY PROJECTS

- Dicot – A c.400-acre site under PPA with planning for 2,170 plots. Expect grant of consent in Spring 2022, with the first plot sales expected shortly after in H1 2022.

- Eastern Green, Coventry – The 357-acre site held under option has planning permission for 2,400 plots, with land sales expected in H2 2022.

- Armthorpe – Our jointly owned housebuilder unconditionally secured planning to build 232 units in South Yorkshire last year, with construction set to begin in 2022.

Urban Development

Definition

With the UK beginning to return to some level of normality after the initial outbreak of the pandemic, there have been signs that big regional cities are recovering in footfall, with the continued belief that more people will be living in urban areas than rural by 2050.

The Group secured two urban development contracts in 2021, with a total value of £89m, whilst also making an acquisition of a site in Birmingham, which will be redeveloped into a 404-unit BtR scheme.

ASSOCIATED BUSINESS SEGMENTS

- Henry Boot Developments Limited

- Henry Boot Construction Limited

KEY PROJECTS

- Summerhill – A £110m GDV BtR development scheme in the city centre of Birmingham, which will redevelop a former Sytner BMW dealership site into 404 apartments.

- Cocoa Works – A £47m refurbishment of the historic Rowntree Factory in York, which will deliver 279 apartments. Works are set to complete in 2023.

- Heart of the City – A £42m mixeduse space, including a seven-storey NZC office building, in the centre of Sheffield.

key long-term structural trends

Market overview

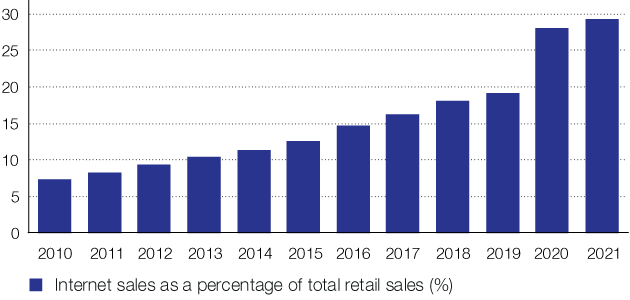

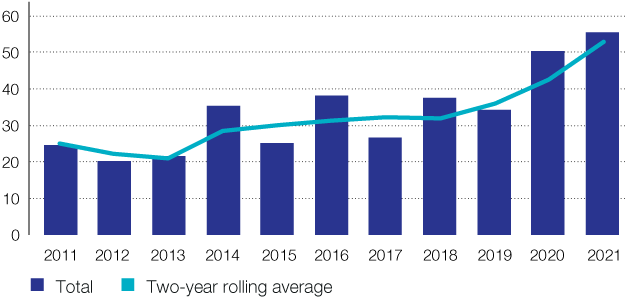

In 2021, there was a UK record industrial space take-up of 55.1m sq ft, with the market continuing to outperform both the office and retail property sectors. In particular, take-up of warehouse space was supported by online retailers, who continued to perform well in last year’s lockdowns. This resulted in internet sales take home percentage of total retail sales increasing to just under 30% and according to DTRE, retailers accounted for 47.4% of UK take-up.

The pandemic clearly has played a significant role in accelerating e-commerce and the digital economy, which has resulted in the industrial and logistics sector performing with remarkable strength in recent times. This looks set to continue, and with vacancy rates at 2.6%, a record low, the market’s outlook remains positive for the future.

What does Henry Boot have to offer:

- A long-standing reputation and expertise in the sector, in particular the Group’s 2,000,000 sq ft flagship scheme, Markham Vale has been offering industrial and logistics solutions since 2004, and in 2021 the scheme has been expanded by a further 750,000 sq ft.

- Last year, planning was secured at Phoenix 10, Walsall, a site capable of delivering c.620,000 sq ft and funding was secured at New Horizon Nottingham to commence and develop a 426,000 sq ft scheme of industrial and logistic space.

- In total, the Group is committed to develop c.1,000,000 sq ft of industrial and logistic space, with a GDV value of £187m GDV (HBD Share £165m).

- Industrial and logistics represents 75% of Henry Boot’s £1.1bn development pipeline with the potential to deliver approximately 8,000,000 sq ft of space.

INTERNET SALES AS A PERCENTAGE OF TOTAL RETAIL SALES (%)

1. Source: Office for National Statistics

BIG BOX TAKEUP – MILLION SQ FT

2. Source: Savills

MARKET OVERVIEW

The residential market performed strongly in 2021, which resulted in a total house price growth of 10.8% last year according to HM Land Registry, as people continued to re-evaluate their housing needs. Housing affordability was also supported by low mortgage rates and the average mortgage payment remained stable at around 30% of people’s take-home pay.

As a result of a buoyant housing market, there was robust demand from UK housebuilders for greenfield land, who were looking to quickly replenish their land portfolios to match the ongoing demand for new homes. According to Savills research, last year saw UK greenfield land values increase by 8.8%, the strongest annual growth since 2014.

What does Henry Boot have to offer:

- Hallam Land Management has six offices located across the country and is well established and experienced in the complexities of the UK planning system.

- The Group has a strategic land bank of 18,012 acres, which has the potential to deliver over 92,500 residential plots.

- Stonebridge Homes, the Group’s jointly owned housebuilder, offers further residential capabilities, with a total land bank of 1,157 plots and in 2021 increased the number of plots that have either detailed, or outline planning permission to 912 plots.

LAND VALUES AND PLANNING CONSENTS1

1. Source: Savills

FIRST TIME BUYER AFFORDABILITY2

2. Source: Nationwide

MARKET OVERVIEW

Whilst the Urban Development market has been impacted by CV-19, there have been signs that our big regional cities are bouncing back, with an increase in footfall. There is a continued belief that by 2050, 90% of the population will live in urban areas, with people choosing to live in rental accommodation within prime urban areas, not only for work reasons but for better lifestyle options in general.

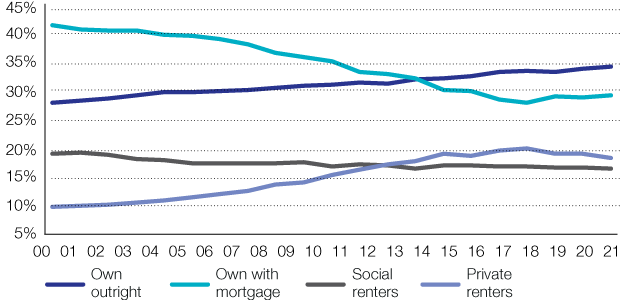

Over the past decade, private renters have significantly increased, and whilst during the pandemic rates have slightly dropped, they remained relatively stable. In particular, BtR rents increased by an average of 8% according to Zoopla research and JLL expect BtR rental growth of 2.7% pa between 2021 and 2025, with regional growth strongest in Birmingham and Manchester.

What does Henry Boot have to offer:

- The Group has a strong presence in key cites identified as target areas for BtR schemes.

- In 2021, the Group completed on Kampus, the 533-unit BtR development in Manchester and further expanded its BtR pipeline by acquiring a site at Summerhill, Birmingham (£110m GDV), which has the potential to deliver up to 404 units.

- Last year, Henry Boot Construction secured two urban development schemes in the city centre of Sheffield and York. Both schemes commenced work in 2021 and we will continue to seek and secure further opportunities within this market.

RENTAL GROWTH

1. Source: Office for National Statistics

HOUSING TENURE

2. Source: GOV.UK